Blog Post

Discovering the Right POS: Our Journey from Startup Bliss to Business Reality

By Steve Bemister | 9 August 2024

My wife and I both had successful corporate careers and wanted to make a change in our lives so we turned-up our entrepreneurial drive and opened our own business. We decided that the type of business that suited us would be home décor, candle manufacturing and custom furniture. After buying a beautiful heritage building in small town Ontario, we thought we were ready to take on this new world.

One of the key steps of a starting-up a new business was overlooked on our part. That was deciding which Point-of-Sale (POS) solution would best suit our needs. Naturally, we talked to other business owners and reviewed what they were using. In hindsight this was our first mistake. We assumed our business model was the same as everyone else’s and one POS systems is the same as the next- how hard could it be?

We decided on a flashy new product that ran on our iPads and iPhones. It had the basics which allowed us to perform sales transactions in a quick manner and most importantly for me, it had a really great looking reports module so I could check-in on how well our business was performing at anytime, anywhere.

All was going well until our business took off and the number of daily transactions far exceeded our wildest imaginations. You would think this would be a happy moment for us but we sat down and started looking at our transaction fees that the POS system was collecting from us. The more business we did, the more we paid out each month.

Let me explain:

We did look at some “legacy” systems but the upfront costs of owning a true POS system was not in our vision- especially at the start-up stage where the bulk of uncertainties enter your thoughts. We just couldn’t afford to look at these systems and the “free” software products were so much more attractive at the time.

Our initial thought process of selecting a POS system was correct when we compared prices of POS systems but making the assumption that would never sell $50,000 in product was not.

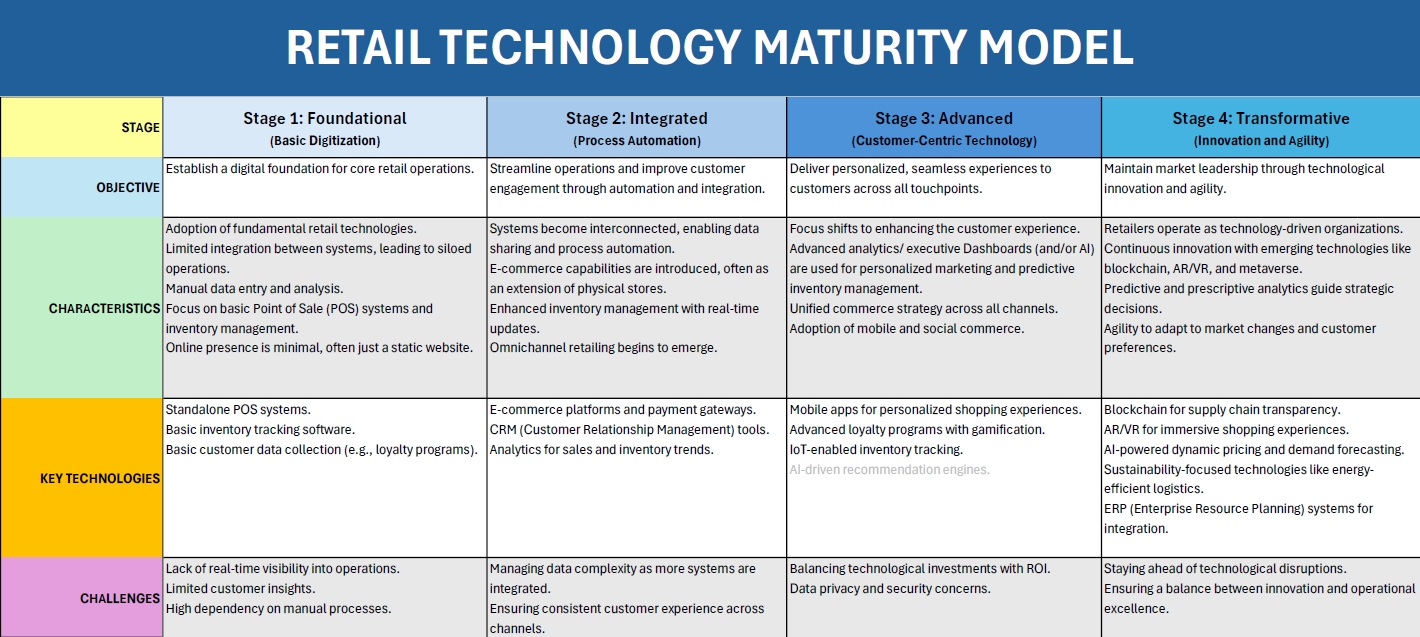

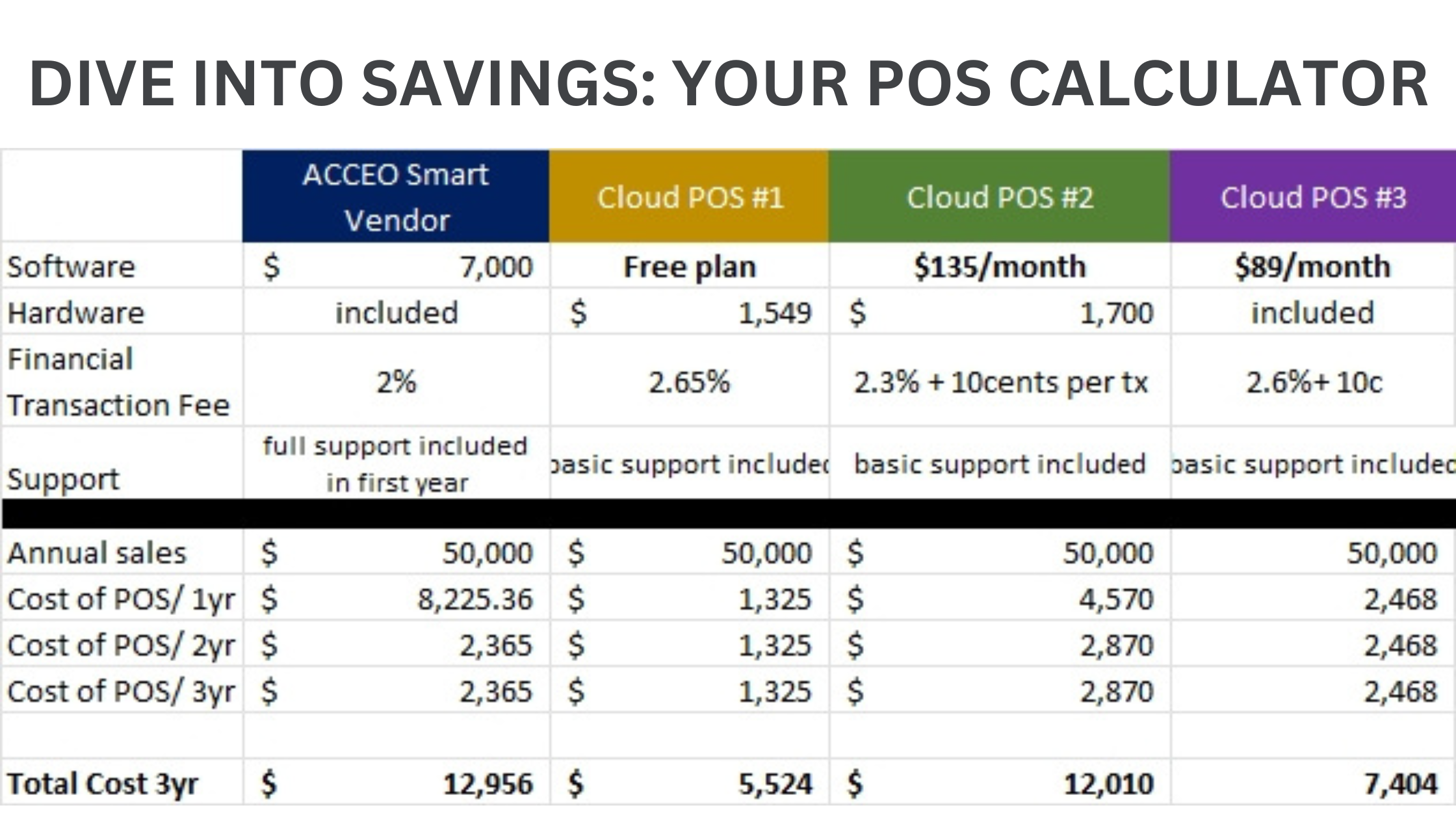

Let’s compare 4 major POS products available today, ACCEO Retail Solutions being the only vendor with a legacy price model.

I think its rather obvious at first glance which POS system the average person would gravitate to. For this exercise, I am ignoring all the other potential fees and costs outside of a basic POS system and focussing on the software, hardware, support and the all mighty financial transaction fee for processing credit cards and debit cards using a processing device. Note that the rates are publicly available from each vendor’s website at the time of this report. Manual entry of credit cards carries a much higher transaction fee and is not considered in these examples.

Assuming our annual sales were up to $50,000 per year, and my average sale was $50.00, investing in the legacy pricing model doesn’t make sense in the first 3 years of business. It might make sense if the business intends to do business over a longer period of time, but not for the short term.

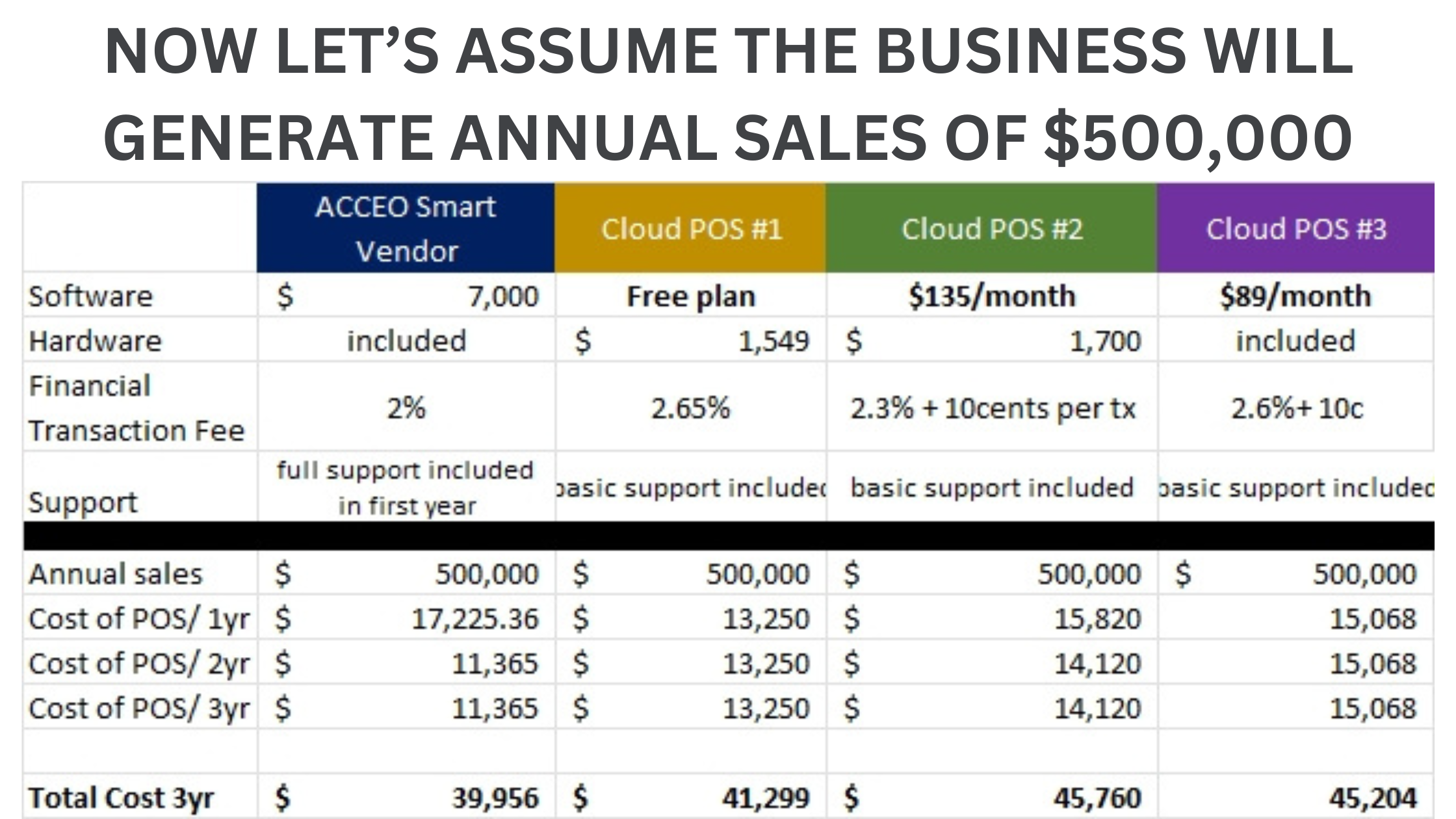

Clearly, we can see the change in Total Cost and that the legacy pricing model starts to make more sense from a business owner’s perspective. If your business surpasses the standard 3-year success rate, the savings are even greater and the ROI happens much sooner. Keep in mind that the ACCEO model includes an annual support fee of $1,104 which offers the option of speaking to a human when issues occur. The other cloud-based vendors offer human support for an additional fee and is not represented in the calculations.

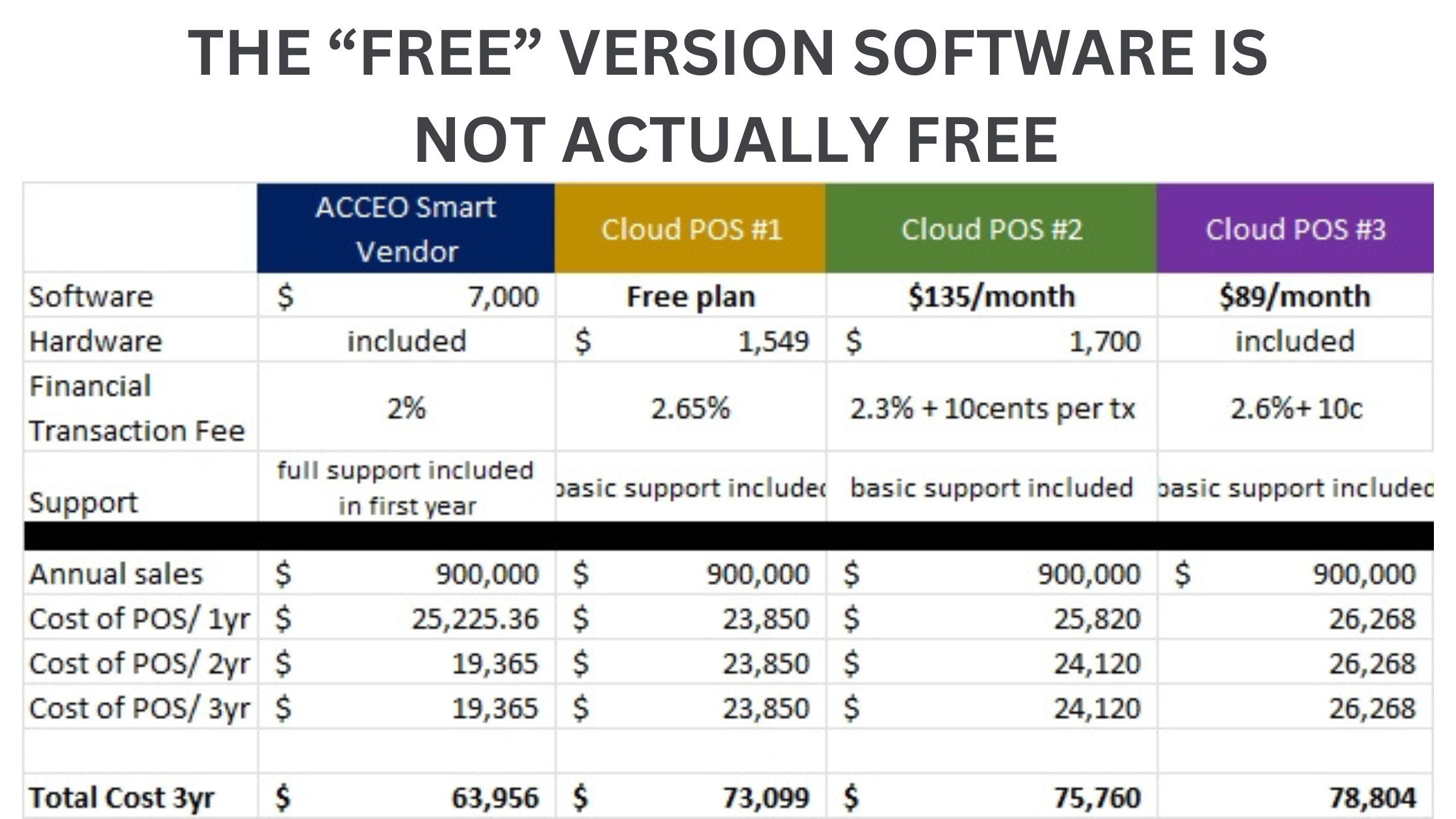

As you might have guessed, as your annual revenue grows, the number of card transactions will likely increasing as well. If you are successful and annual sales reach $900,000 or more, you’ll quickly understand that the “free” version software is not actually free!

The first-year cost of the POS is actually at par with the “free” versions but more importantly is the growing price of payment processer fees. The calculations above assumed an average sale of $50.00 so keep in mind that the more transactions, the higher the cost becomes.

At this point, one has to wonder which pricing model works best for their own business needs. For us, our business was improving month over month and it was important to stop the revenue bleed each month or at least reduce it as much as possible. Had I gone with an ACCEO Retail Solution product from the start, I would have an extra $10,000-$15,000 to put towards marketing and advertising.

Key Points

- The transaction fee is the important factor in this entire exercise. The 2% payment process fee rate used with ACCEO Retail Solutions is not their product/fee but one of a 3rd party payment processer easily found by shopping online. Any rate higher would yield different results.

- Free is not free. Don’t make the mistake of considering a POS simply because of price. As you can see, the price of the software itself is not the bulk of cost but the transaction fee/rate is- especially over time.

- Locked-in contract danger. The cloud-based solutions generate the bulk of their revenue from payment processing and not the actual software. If your store has a smaller annual revenue, their pricing model will not support their business model and therefore they will force you into long-term contracts that are difficult to get out of. Some of these vendors also force you to use their payment process solution only because the last thing they want is for you to use their free software and someone else’s payment processer that offers a lower rate.

- The legacy pricing models are a bit hard to digest when starting out in business but almost all offer financing options to help with the decision process. Make sure you ask when shopping for a POS system.

- Black-outs. They happen. The recent Rogers outage left businesses in the dark for 19 hours. Business could not access their cloud-based POS system because it relies solely on the internet to access the database. Businesses were not able to process transactions via payment process machine so they were asking customers to go down the street, find an ATM and come back with cash. DO NOT DO THIS! You are harming your new business in so many ways (poor customer experience, bad reviews on social media, harmed reputation and generally bad business). Just turn off the lights and close until internet gets restored. Legacy systems typically store their databases on a server in the store so business can continue as usual and is why they are so popular in rural areas of the country.

- Feature lock. Make sure you compare apples with apples when reviewing the different POS systems. The system we chose initially had a limited amount of product SKUs that we could use in the “free” version. We filled that capacity up as quickly as the business grew. The only remaining option was to upgrade to the next price plan which gave us a bunch of features that we would never use but was necessary to have for the increased inventory capacity needed to run our business efficiently. Since the cloud-based system store your data in the cloud, the cloud hosting fees increase with more data added to it. In other words, the bigger your business gets, the higher the hosting fees become which vendors often pass the charge onto the customer. These are the unexpected costs that eat away at your profitability and success.